NetSuite Fixed Assets Management provides you with the power to eliminate spreadsheets and manual effort from your company’s asset and lease management processes. NetSuite’s solution gives you an easy-to-manage single version of the truth for company-owned and leased assets, a flexible depreciation and amortization schedules, detailed asset reporting and seamless integration with NetSuite’s core accounting functionality.

NetSuite Fixed Assets Management enables you to maintain and control the complete asset

lifecycle from creation to depreciation, revaluation and retirement. Its detailed asset management functionality supports multiple depreciation calculation types, handling of depreciating and non-depreciating assets, maintenance schedules, lease accounting and insurance.

NetSuite Fixed Assets Management allows you the flexibility to select which accounting period to depreciate. As an example, with fixed assets seasonal withdrawal and depreciation, you can choose not to depreciate the asset using asset lifetime usage. Instead, you have the option to stop the asset depreciation during downtime.

You can assign tax depreciation methods to an asset. These assignments enable tax reporting or corporate reporting methods to be tracked on the asset. Tight integration with NetSuite Financials creates accounting entries and fixed assets from purchases to help ensure that no equipment slips through the cracks.

Key Benefits

- Manage the complete asset lifecycle.

- Completely integrate asset management with accounting.

- Maintain accurate records for compliance and reporting.

- Eliminate manual effort and multiple spreadsheets.

- Easily track company-owned and leased assets.

- Leverage support for all standard and custom depreciation methods.

- Ensure compliance with lease accounting standards and regulations.

- Automatically post asset transactions directly to NetSuite accounts.

- Accurately report valuation, depreciation, expense and amortization.

- Manage asset data and lease agreements department and other segments.

Acquire, Depreciate, Retire, Transfer and Revalue Assets

NetSuite Fixed Assets Management supports the entire company asset management lifecycle, from creating a purchase order within NetSuite to tracking, depreciation and eventual retirement. It supports unlimited asset types, whether they are subject to depreciation or are non-depreciating assets that simply need to be tracked. NetSuite Fixed Assets Management makes asset creation easy, enabling you to default in types when creating an asset and specify and maintain key fields and details relating to a particular asset. It allows you to:

- Easily create, manage, track and report on any asset type.

- Control all asset-related transactions to company assets including asset proposal, creation, depreciation, revaluation, transfer, disposal and split.

- Easily track depreciating or non-depreciating company assets.

- Quickly create assets based on unlimited asset types, and report on them.

- Create assets with the correct quantity and values allowing users to have multiple proposal records from a transaction with more than one quantity to create multiple assets.

- Maintain all relevant asset details for assets, including insurance, lease agreements and maintenance schedules.

- Use automated defaults for asset creation, depreciation and eventual retirement with minimal effort.

- Track and depreciate individual components based on their own depreciable cost and useful life.

- Move assets from one location to another or from one subsidiary to another.

- Increase or decrease asset values through revaluation to reflect its current market value.

- Account asset’s expenses for repairs.

Comprehensive Support for Depreciation

With NetSuite Fixed Assets Management, you gain complete flexibility to depreciate assets based on the right depreciation method. NetSuite Fixed Assets Management provides out-of-the-box methods, as well as flexibility that enables you to create your own depreciation methods, even supporting depreciations for both financial and reporting purposes.

- Leverage built-in support for all standard depreciation methods, including straight line, fixed declining, sum of years digits and asset usage.

- Create customize user-defined depreciation methods.

- Use “chain” depreciation methods to support comprehensive asset valuations.

- Apply multiple depreciations per asset for reporting depreciations.

- Computes monthly and daily depreciation.

Ready to Simplify Your Asset Management?

Transform how you track and manage your company's fixed assets. Say goodbye to spreadsheets and manual labor - embrace the precision and convenience of an integrated solution! With flexible depreciation schedules, comprehensive reporting, and full integration with core accounting functions, managing your assets has never been easier!

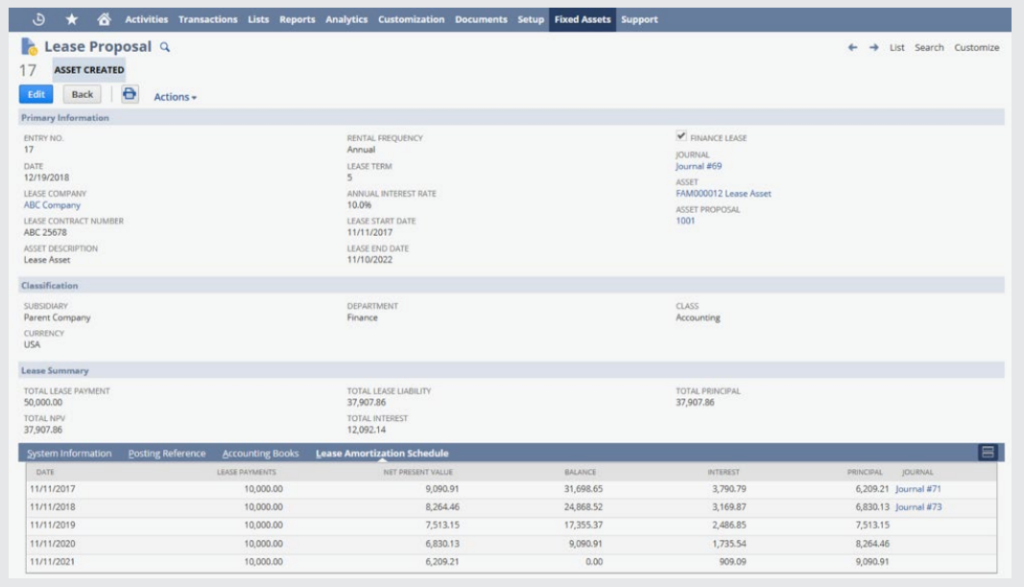

Efficient Lease Management Compliance

NetSuite Fixed Assets Management simplifies lease payment, amortization and reporting, helping you comply with the latest tax rules and accounting standards. With NetSuite Fixed Assets Management, you can easily create, update and track finance and operational leases. NetSuite Fixed Assets Management separates lease and interest expenses and updates lease values automatically, streamlining the monthly close process.

- Standardize lease accounting processes across your business.

- Ensure compliance with ASC 842, IFRS 16 and GASB 87 standards.

- Import existing amortization schedules or create custom schedules as new leases are added.

- Automatically post journal entries with separate lease and interest expense.

- Improve financial statement accuracy and transparency.

Complete Integration with NetSuite Accounting

NetSuite Fixed Assets Management enables you to easily create fixed assets from purchase orders while ensuring that all asset depreciations and disposals are posted to NetSuite’s core

accounting system.

- Automate the creation of assets from

purchase orders. - Post depreciation and asset retirements directly to NetSuite accounts.

- Streamline the entire process, including journal posting, bill posting and PO billing posting.

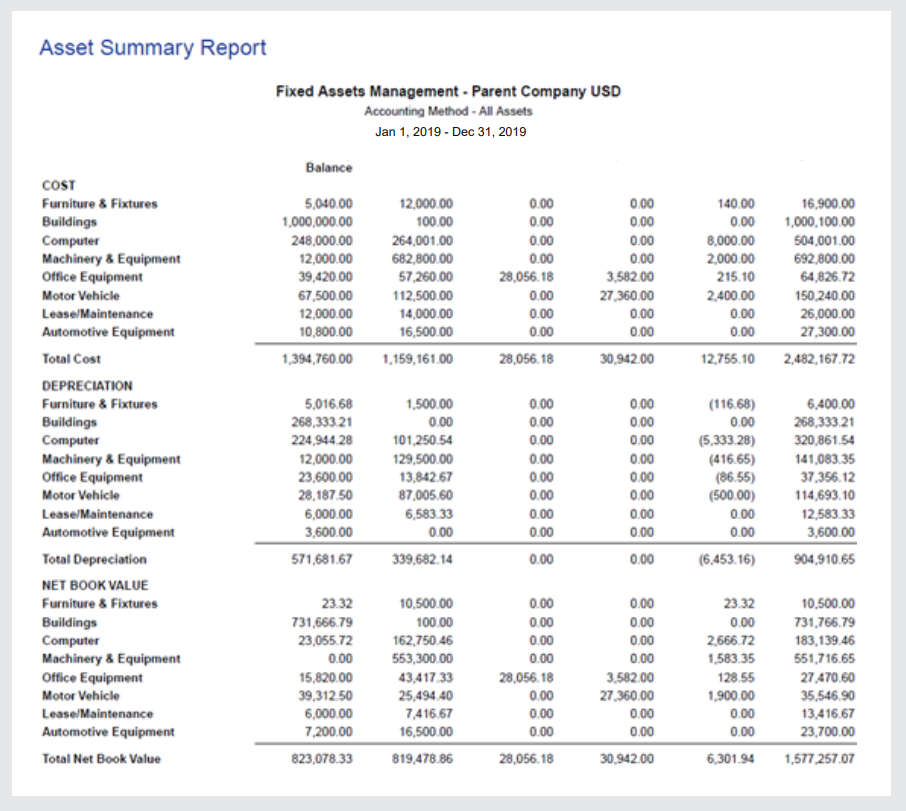

Real-Time Fixed Assets and Lease Reporting

With NetSuite Fixed Assets Management, you can leverage the full power of NetSuite dashboards and reports to analyze and report on company-owned and leased assets.

- Easily run preconfigured reports for all your fixed and leased assets needs.

- Comprehensively report across fixed and leased assets, valuation, present value, expense and depreciation.

- Automatically create reports for leased payments, including net present value, interest and principal.

- Slice and dice fixed and leased assets across locations, subsidiaries, asset types and more.

- Quickly run pre-built saved searches on items including monthly depreciation, asset additions/ disposals, asset list, asset register, lease proposal history, inspection due, insurance renewal due, expiring leases and more.

)